Welcome back. This is Coco again. Animoca Brand’s Chairman Yat Siu made a comment at a conference in LA recently that Pro-capitalist Asian countries are more likely to embrace Web3. Do you agree?

This issue covers some encouraging updates and developments in global partnerships, CBDC adoption, new licenses, new Web3 funds and ventures, blockchain applications, as well as regulations, across Mainland China, Hong Kong, Taiwan, India, UAE, Singapore, and Japan. I also highlight a research by Electric Capital tracking the change in the number of Web3 developers globally and share 3 upcoming conferences in Hong Kong, Japan, and Korea.

Companies covered in this issue:

Ava Labs|Tencent|NBA|Ant Group|WeChat Pay|e-CNY|Shanghai Futures Exchange|Animoca Brands|Hex Trust|Gryfyn|HashKey Group|Kratos Studios|IndiGG|JP Morgan|Liberty City Ventures| Komainu| BitRock| Coinbase|Standard Chartered|bitFlyer|Sony

Keep reading.

Mainland China

⓵ AVA Labs & Tencent Cloud

A collaboration between Ava Labs, the team behind the Avalanche blockchain, and Tencent Cloud, a cloud computing service provider, has been established to enable fast deployment of nodes on the Avalanche public blockchain across APAC.

⓶ A partnership between NBA and AliPay

NBA China announced its partnership with Ant Group. The project starts with the integration of NBA’s livestreaming and content on AliPay’s platform and will roll out NFT offerings down the road.

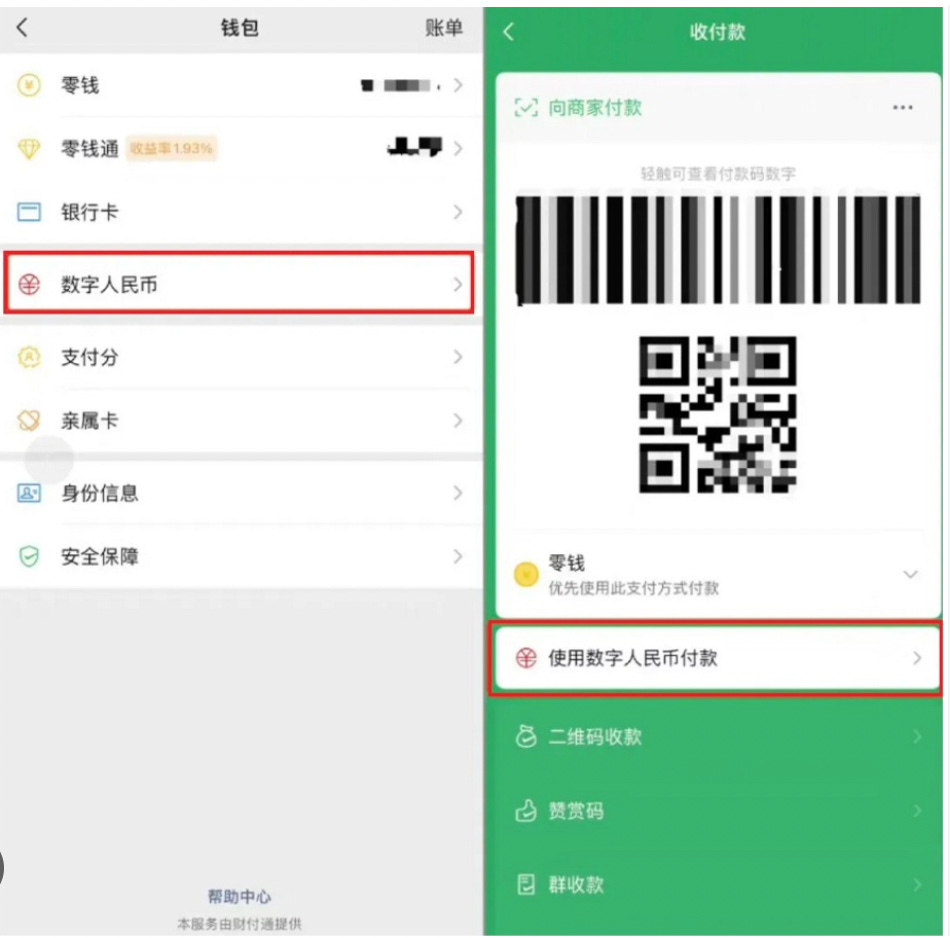

⓷ China’s CBDC & WeChat Pay

WeChat, a popular messaging and payment app in China, has integrated the CBDC or e-CNY into its payment services, as did AliPay. This move is part of the Chinese government's efforts to promote the adoption of e-CNY, which has been in development since 2014. Six of China’s state-owned banks support e-CNY. By integrating e-CNY users have one more option to pay vendors.

Right now, the daily transaction limit is RMB 5,000 ($727) and each transaction limit is RMB 500 ($73).

Some Hong Kong residents are selected to receive e-CNY airdrop. They are able to place orders with Mainland vendors such as Jingdong and settle the cross-border payment via e-CNY.

⓸ China’s regulator pushing for blockchain application in commodity futures exchanges

The China Securities Regulatory Commission (CSRC) has been encouraging the use of blockchain technology in the capital markets and has responded to a proposal on accelerating the pilot application of blockchain technology in the commodity futures industry.

For example, the Shanghai Futures Exchange has already applied blockchain technology in the national bulk commodity warehouse receipt registration system in the Qingdao alliance chain and Zhejiang alliance chain and plans to expand its projects and introduce the Internet of Things technology to create a national-level infrastructure, according to some Chinese media’s reports.

Hong Kong

◐ Asia is more pro-capitalism than North America

Yat Siu, Chairman of Animoca Brands, commented at a conference in LA that pro-capitalist Asian countries, such as Singapore and Hong Kong, are more likely to embrace Web3 due to their already developed digital economies and openness to innovation. Compared with North American counterparts, “the adoption, readiness and willingness actually sit in Asia. Like, you go and want to sell something to people in Japan or Korea or Southeast Asia, you'll find a much more ready market versus over here.”

◑ Joint venture Gryfyn between Animoca Brands and Hex Trust

Animoca Brands and Hex Trust have formed a joint venture called Gryfyn to launch a multi-chain custodial wallet for NFTs with bank-grade security.

Gryfyn completed the fundraising of $7.5mm from backers including Liberty City Ventures, which is behind Paxos.

◒ Chinese major banks in Hong Kong start courting crypto firms

Hong Kong branches of some Chinese banks, the Bank of Communications, Bank of China, and Shanghai Pudong Development Bank, are reported to have reached out to crypto firms in Hong Kong.

It is pivotal for crypto firms to be able to have a banking relationship if Hong Kong’s ambition is to lure crypto companies to Hong Kong. However, it is not too long ago that all Chinese banks including their Hong Kong branches were banned from banking crypto companies.

Even if these banks are willing to support crypto firms, questions remain about whether they are compliance and technology ready. If none of them is ready to bank crypto companies, will Hong Kong’s banking regulator Hong Kong Monetary Authority allow exchanges to integrate with international banks such as those in the U.S.?

◓ HashKey Group receives an OTC license from SFC

In addition to virtual asset licenses Type 1, and Type 7, HashKey Group recently received an OTC license from Hong Kong’s regulator SFC.

According to some sources, applying for all licenses 1, 7, 4 (investment advisory services), and 9 (asset management) in order to offer a full line of services related to virtual assets may cost up to $20mm and take 2 years.

Over 80 companies express interest in setting up shops in Hong Kong.

Taiwan

Compared with Mainland China, Taiwan had been more tolerant of cryptocurrency until after FTX’s scam, which has harmed a good number of retail investors. Taiwan is expected to step up with the regulation and the Financial Supervisory Commission (FSC), which oversees the banking, insurance and securities market, will be the authority to regulate cryptocurrencies except for NFTs, which may fall under another regulatory agency.

India

🌟 Cryptocurrency companies to comply with money laundering act

India’s Finance Ministry made a move to bring cryptocurrencies under the Prevention of Money Laundering Act (PMLA). The industry is still evaluating its implication. Different from most other countries, India does not have any government agency responsible for cryptocurrency.

💫 New gaming venture in India with a $20mm raise

Indian gaming veterans launched another venture Kratos Studios, which acquires one of the largest gaming DAOs IndiGG through a token swap.

✨ Blockchain technology to be used in Indian local banks’ USD clearing and settlement

J.P. Morgan is helping Indian banks with USD real-time clearing and settlement through its blockchain-based solution.

UAE

Two crypto custodians receive regulatory approval in Dubai

Crypto custodian Komainu received provisional regulatory approval to operate in Dubai. Komainu is a joint venture of Japanese investment bank Nomura, European digital asset manager CoinShares and French hardware wallet maker Ledger. Hong Kong-headquartered Hex Trust also received provisional regulatory approval from Dubai.

Singapore

⌱ A $100mm new fund to be launched

A Singapore Fintech investment firm BitRock is raising a $100mm fund to invest in finance and blockchain startups in China and Southeast Asia.

⌭ Coinbase offering local bank transfer

Coinbase enables local customers in Singapore to transfer funds in and out of the exchange from their bank accounts at Standard Chartered with no fee.

⍧ MAS considering regulating stablecoins

Singapore’s regulator is considering regulating any stablecoin with circulation above $3.7mm and allowing local banks to issue stablecoins.

Japan

◈ bitFlyer co-founder and former CEO interested in a comeback

Yuzo Kano has an ambitious plan to reinvigorate bitFlyer including issuing the platform’s own stablecoins, providing more services and international expansion.

◪ Sony making moves to grow its presence in Web3

Sony filed a patent that allows NFTs to transfer between games and consoles.

Market Data

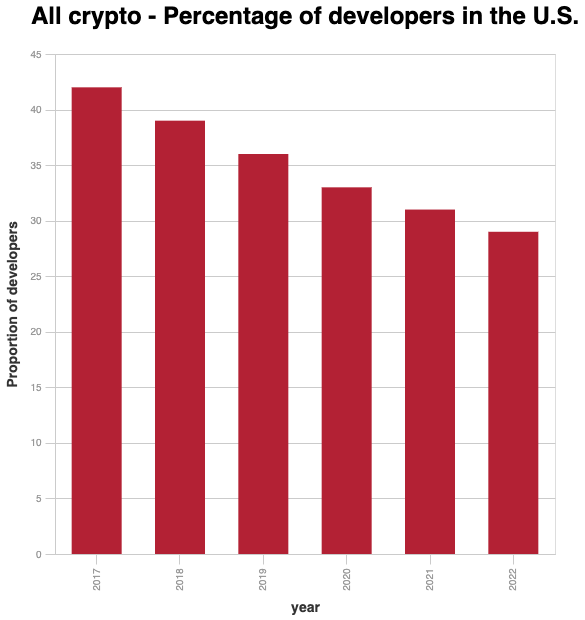

According to research by Electric Capital, the number of U.S. Web3 developers is decreasing. Which countries/regions are capturing the share?

Conferences in Asia

Hong Kong Web3 Festival April 12-15

Teamz Web3 Summit in Japan May 17-18

Korea Blockchain Week Sept. 5-6

About the author

In the innovative blockchain, crypto & digital asset ecosystem, Asia is the other side of the coin. Blockchain & Crypto Asia, which covers exclusively blockchain and crypto & digital asset developments in Asia, including regulation, investments, and company highlights, helps you stay on top of what is going on in the Far East. The curated content is selective and serves as information, and personal views only, not investment advice.

I am the co-founder of Kee Global Advisors. Please email me with any ideas or thoughts. I’d love to hear from you! You can also follow me on Linkedin and Twitter.