The frustration, confusion, and disappointment with the U.S. regulatory landscape continue to spread in the U.S. At the same time, regulatory developments in other countries are energizing.

I am Coco.

Let’s look at what is going on in regulatory development outside the U.S. The central government of China, the presumed hard-core crypto hater, entertains Hong Kong’s efforts to turn the island into a global virtual asset hub. Charlie Munger, who asked the U.S. to follow China’s example to ban crypto, may feel betrayed.

After BUSD, is USDT safe? The picture of stablecoins’ market cap is telling.

Regulatory Developments

In one of his recent tweets, Brad Garlinghouse of Ripple highlighted the developments of regulatory policies in some jurisdictions outside of the U.S.

Let’s see what those positive developments are that energizes him.

Australia

The Treasury of the Australian Government published “Token Mapping Consultation Paper” last August for the industry to submit feedback. The deadline is March this year. The consultation paper states,

“token mapping is the process of identifying the key activities and functions of products in the crypto ecosystem and mapping them against existing regulatory frameworks”.

The approach of the mapping is based on a paper published by the Bank for International Settlements. After the token mapping, a consultation paper for licensing and custody will be released in mid-2023 for the industry’s input.

The Treasury will take into consideration the recommendations from the industry to reform existing practices for better investor protection without sacrificing innovation.

Dubai

Dubai’s regulator Virtual Asset Regulatory Authority (VARA) published a set of rulebooks in “Virtual Assets and Related Activities Regulations 2023”, on Feb. 7, 2023, which lays out a regulatory framework for virtual assets, including licensing and registration requirements for conducting businesses related to virtual assets in Dubai.

On the UAE federal level, VA Resolution passed by the government came into force on January 14, 2023, which provides a framework to regulate virtual asset activities and service providers and to protect consumers.

Hong Kong

On February 20, Hong Kong’s Securities and Futures Commission (SFC) published a 361-page “Consultation Paper on the Proposed Regulatory Requirements for Virtual Asset Trading Platform Operators Licensed by the Securities and Futures Commission”.

After the consultation period, the regulation will take effect in June 2023. With much certainty, the licensing regime will be applied to all centralized exchanges in Hong Kong; SFC is considering allowing retail investors to trade spot cryptocurrencies. [See Page 12 of the Consultation Paper] As of today, only two institutions, OSL and HashKey Group, have received approval to offer crypto trading services to professional investors.

South Korea

South Korea’s Financial Services Commission provides guidelines for the issuance and circulation of security tokens (STOs). These guidelines include definitions of securities for digital assets, and the regulatory foundation necessary for ensuring the appropriate issuance and circulation of STOs.

Stablecoins

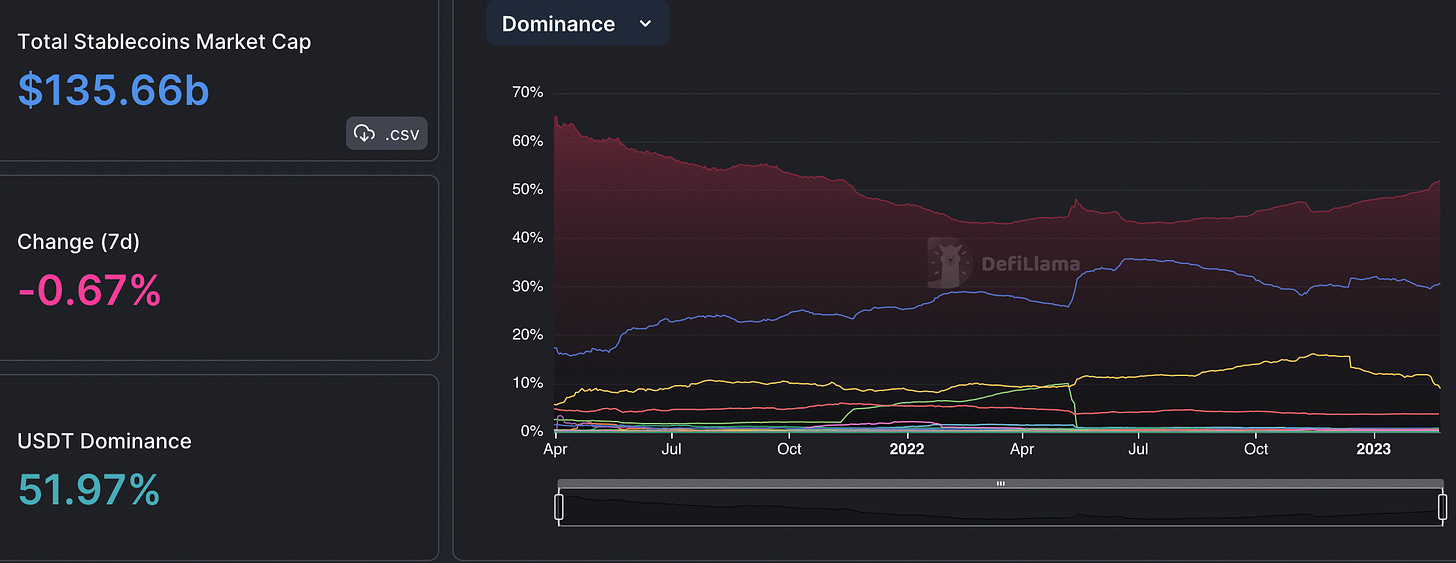

A LinkedIn post by Martin Masser “USDT is the stablecoin of safety” caught my attention. I checked the market cap data of USDT, USDC, and BUSD on DefiLlama.

(Screenshot of DefilLama’s Stablecoins Market Cap. Red=USDT, Blue=USDC, Yellow=BUSD)

It is obvious that USDC has picked up some market share while USDT’s dominance declined between 2021 and to date.

Zooming in, USDT started to lose its absolute dominance in November 2021, falling below 50% from as high as 85% in August 2020, hovering in the range of 43-47% until mid-February 2023, when it reclaimed its 50%+ market share.

According to Chainalysis’ research report in 2020, the usage of Tether mostly came from East Asia, esp. China. USDT’s decline seems to coincide with China’s “resolute clamp-down” starting mid-2021, including wiping out Tether’s OTC network throughout China and banning bitcoin mining.

If Chainalysis’ observation still applies, can I boldly conclude that the recovery of the market share of USDT indicates a thawing of crypto winter, at least in Asia?

As the third largest stablecoin, BUSD’s market share had a steady growth between November 2021 and December 2022, from 9% to 15%+, then back to 9% in mid-February 2023.

Paxos has issued a total of $16 billion BUSD for Binance since 2019 with the approval of NYDFS. In mid-February 2023 NYDFS ordered Paxos to stop minting BUSD. $700 million of BUSD has been burnt by Paxos by February 14, 2023. BUSD’s market share dropped from $15.35b on February 15, 2023, to $11.8b on February 23, 2023.

CZ said that Binance is looking to explore more Euro- and Japanese Yen-based stablecoins.

“There’s multiple agencies putting applied pressure there. It is just going to shrink the U.S. dollar-based stablecoin market,” CZ added.

How will the ongoing redemption of BUSD change the dynamics of USDT and USDC between now and 2024? Will there be a non-USD-backed stablecoin rising out of nowhere through the partnership with Binance to challenge USDT and USDC? How will regulatory uncertainties affect U.S. dollar-backed stablecoins?

Regulators outside of the U.S. including Japan, Singapore, and Hong Kong, as well as the EU, are drafting policies and creating regulatory frameworks for stablecoins. The race to introduce policies and regulations for stablecoins on one hand is to maintain financial stability, however, it is not hard to see that it may also evolve into a race for market share of the underlying sovereign fiat currency of stablecoins. The U.S. does not want to lose this race.

Thank you for reading, until next time.

In the innovative blockchain, crypto & digital asset ecosystem, Asia is the other side of the coin. Blockchain & Crypto Asia, which covers exclusively blockchain and crypto & digital asset developments in Asia, including regulation, investments, and company highlights, helps you stay on top of what is going on in the Far East. The curated content is selective and serves as information and personal views only, not investment advice.

I am the co-founder of Kee Global Advisors. Please email me with any ideas or thoughts. I’d love to hear from you! You can also follow me on Linkedin and Twitter.