㊍Asia is pushing for mass adoption, while the U.S. needs more disinfectants | BlockchainAsia #52

BTC vs. Gold, vs. AI, rate cut or not, RWA that connects Asia and Middle East, the largest pension fund is researching crypto, FalconX expands to Hong Kong, 4 events in Asia worth attending

March 26, 2024

Welcome back to BlockchainAsia. I am Coco.

In this issue, I talk about the trends of Bitcoin and ETH in comparison with Gold and AI. I look into the Macro. The Fed paints a rosy picture of the U.S. economy, while globally I see some major economies sliding into recession.

Deals and positive developments in Asia continue to flow. As some of my subscribers suggested, I have added some U.S. updates to this issue and will do so for future ones.

I enjoyed the three interviews conducted up to now and am sharing them via BlockchainAsia Podcast.

I list 4 events in Asia.

✍️Trends

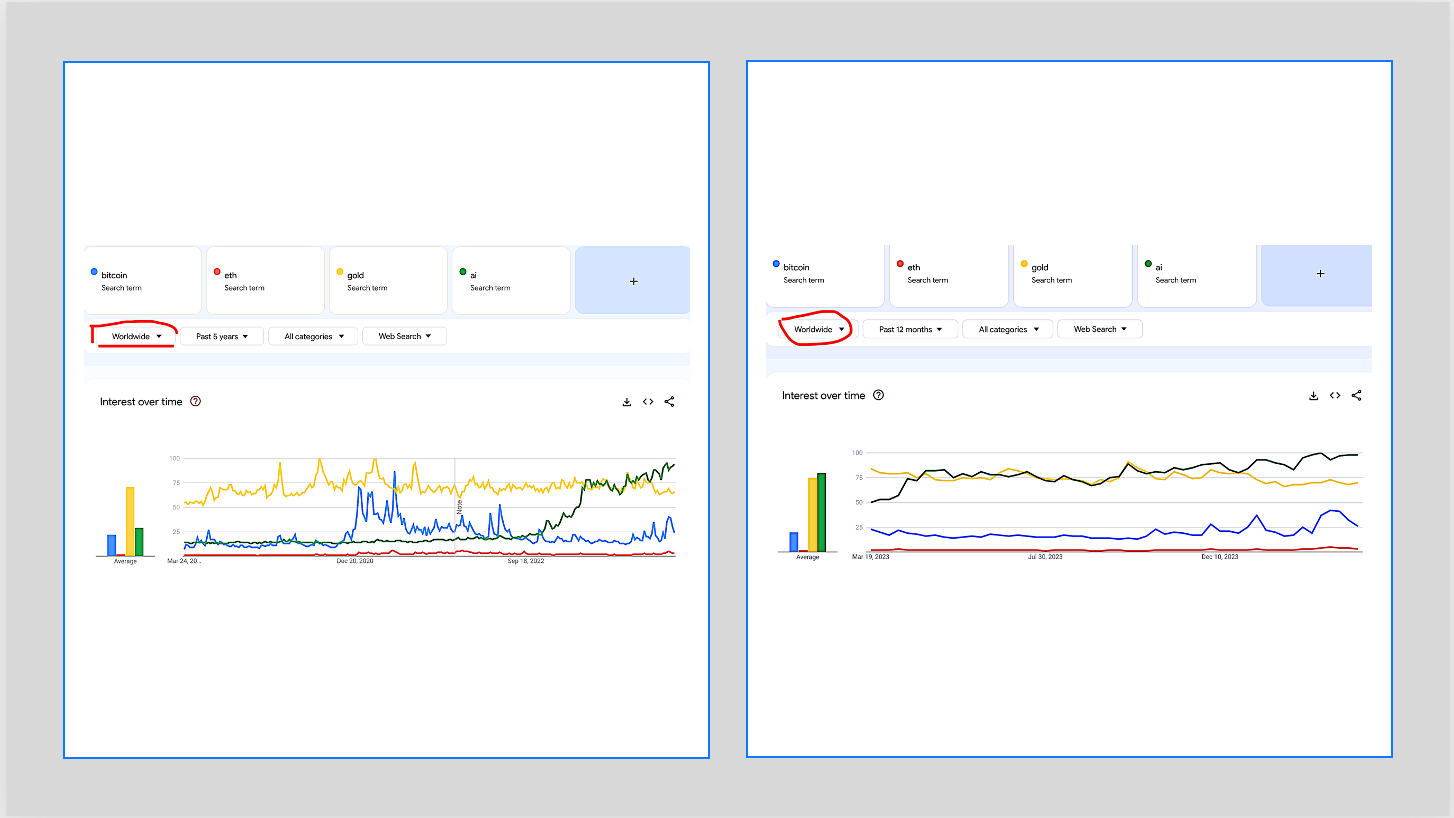

The trends in worldwide Google searches give us some perspective on where BTC and ETH are and their popularity in comparison with Gold and AI.

Chart I, Google trends show that AI has overtaken the search for Gold since around March 2023; the search for Bitcoin is below the peak during late 2020 and early 2021, when the search for Bitcoin was more popular than Gold.

The search for ETH has been flat regardless of the expectation for a spot ETH ETF.

Chart I

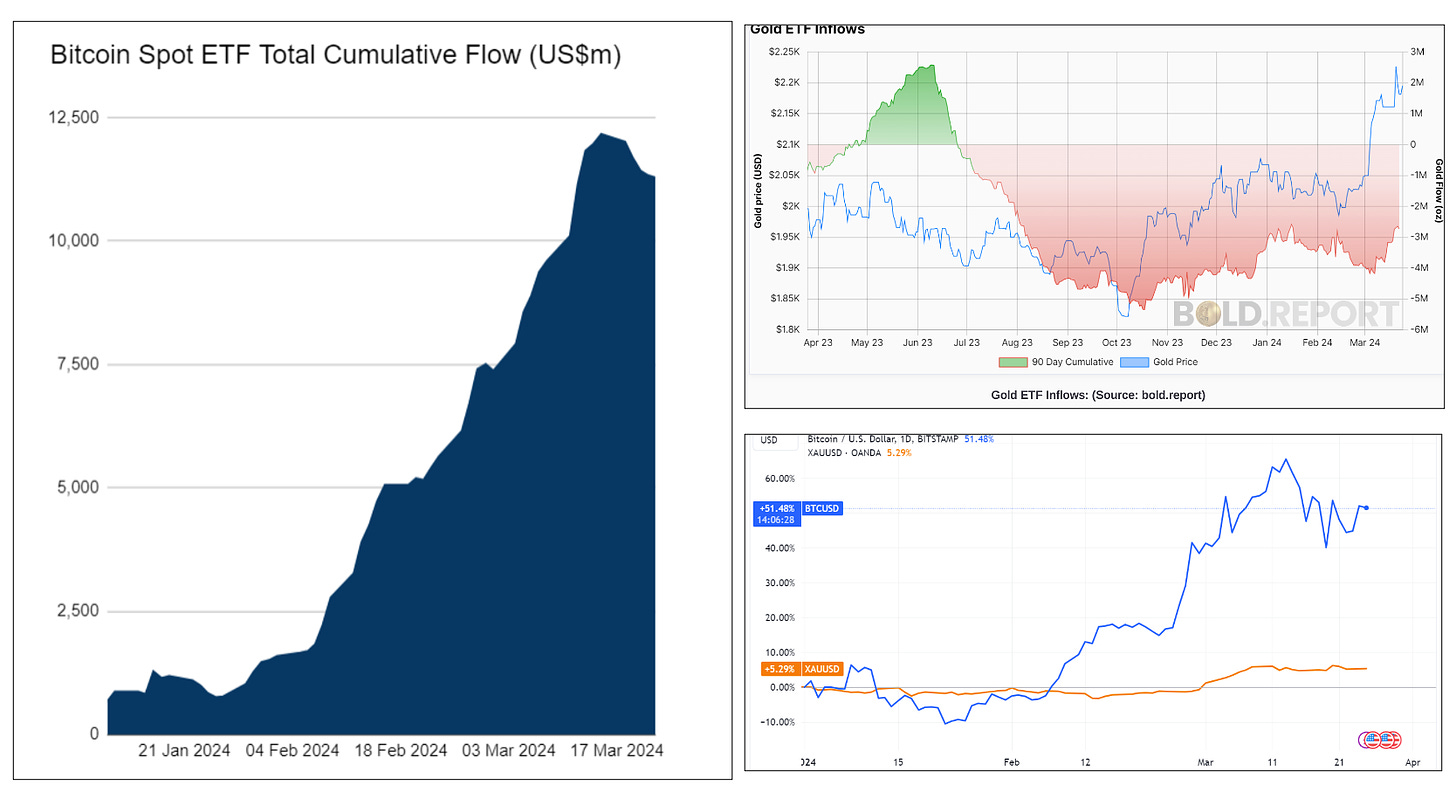

Bitcoin’s market cap is approximately 10% of Gold. Chart II includes BTC Spot ETF’s and Gold’s cumulative flows. YTD, BTC’s return is 51.5% vs. Gold’s 5.3%.

In January 2012, Gold’s price was around $1,700, and on March 26, $2,218.

In January 2012, Bitcoin’s price was about $6.5, and on March 26, over $70,6000.

Chart II

📈Macro

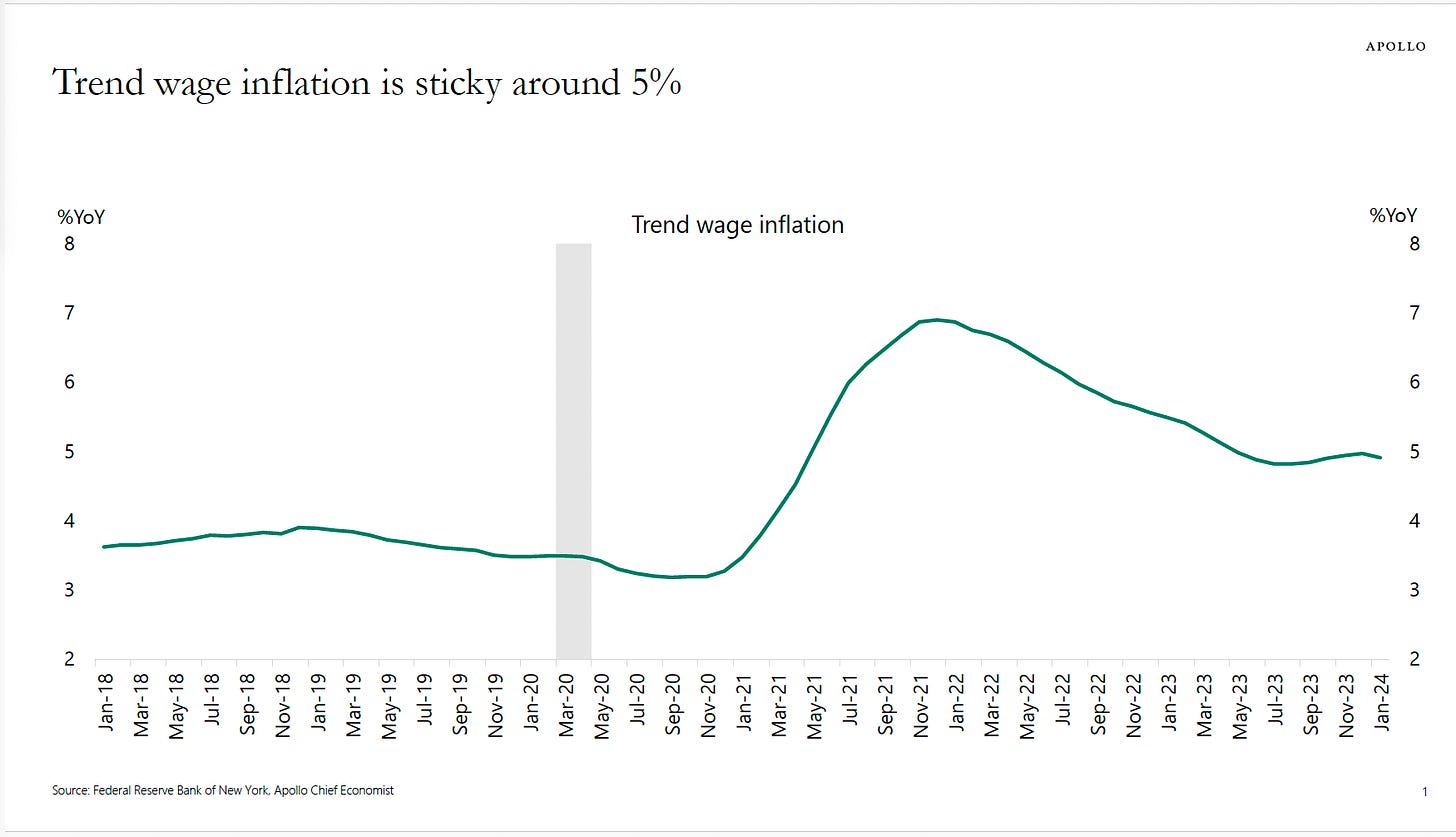

According to Torsten Slok of Apollo, “the New York Fed has constructed a new measure of trend wage inflation, which currently is running at 5%, see chart below. Wage inflation at 5% is not consistent with the Fed’s 2% inflation target. The Fed will keep interest rates higher for longer. “

Larry Summers in his recent interview with Bloomberg comments, “My sense is, Fed is still itchy fingers to start cutting rates. I don’t get it.” The market is revising its expectations of the Fed’s rate cuts from 6 or 7 to 3. How about none?

Outside of the U.S., however, the economic picture is not as rosy. The U.K. and Germany are in a recession.

Japan, after revision of its economic data, narrowly escaped a recession. In the past week, the Bank of Japan ended its 8-year-long negative interest rates.

IMF published a report on China’s housing market situation: although housing sales and real estate starts have dropped significantly, “key property sector vulnerabilities have yet to be addressed, pointing to ongoing risks to sustainability. Many developers have become non-viable but have avoided bankruptcy thanks in part to rules that allow lenders to delay recognizing their bad loans, which has helped mute spillovers to real estate prices and bank balance sheets. Home prices have also decreased only modestly in part because some cities have sought to limit price declines through rules and guidance on listing prices.”

🥇Deals

Mystiko Network, a ZK infrastructure, completed its $18M seed round led by Sequoia Capital India/SEA (now changed to Peak XV Partners), other investors include Samsung Next, HashKey Capital, Mirana, Signum Capital, and more. Mystiko on Twitter

South Korea’s crypto exchange Bithumb targets an IPO in its domestic market in 2025 and, if successful, will become the first publicly traded exchange in the country. At the same time, the neobank K Bank in South Korea, which provides crypto exchange Upbit on/off ramps services, is also considering an IPO. Crypto News

MediConCen, a Hong Kong InsurTech using Blockchain and AI raised $6.85M A round led by HSBC Asset Management. MediConCen News

Startale Labs, which develops Web3 infrastructure and applications for mass adoption, receives $7M seed funding from multiple Web2 companies including UOB’s venture arm, Samsung’s Venture arm. It also has a joint venture with Sony Network Communications. Startale Labs’ blog

Mantra, an application chain designated to RWA tokenization built on top of Cosmos SDK, raised $11M. In addition to the chain, it will also have an exchange for RWA tokens. In the middle of getting approval from Dubai’s VARA, Mantra will serve Asia and the Middle East. This round is led by Shorooq Partners, a VC focusing on the MENA region. Mentra’s LinkedIn

AI Web3 startup Bluwhale in Silicon Valley raised a $7M seed round led by Japanese investor SBI, both SBI Ven Capital and SBI Decima. Bluwhale uses AI to link companies to wallet holders who have opted in, enabling dApps to directly reach their audience and reward them. SBI Ven Capital

🚀Developments

The world’s largest pension fund ($1.53T AUM), Government Pension Investment Fund, Tokyo, issued a request for information about illiquid assets including crypto, e.g. Bitcoin, which it does not have exposure to yet. Pensions&Investments

Japan is moving closer to allowing VCs to directly hold crypto assets. CoinDesk

HashKey Group’s OTC arm received in-principle approval from Singapore’s MAS to offer regulated digital token services in Singapore. HashKey Group

South Korea’s National Tax Service, the U.S. equivalent of the IRS, is building a monitoring system “Integrated Cryptocurrency Management System” that will enable it to combat tax evasion. The system is to be completed by 2025. Blockchain News

Hong Kong is looking into launching a sandbox for a wholesale CBDC project to further support the tokenization economy. Hong Kong Monetary Authority

Hong Kong launched a stablecoin sandbox. CoinDesk Also see the comment made by the Crypto Council for Innovation on the public consultation paper for stablecoin legislation.

Hong Kong lays out guidance for custodial services. CoinDesk

This photo, a red-tail hawk, is taken by my friend in Canada. He is a photography enthusiast. I enjoy his wildlife photos the most.

🇺🇸U.S. - Related

As suggested by some subscribers from outside of the U.S., I am adding some U.S. updates to my newsletter.

Three top deals in the U.S., Figure Markets (digital asset marketplace) raised $60M, Succinct (ZKP infrastructure) raised $55M, and Espresso Systems, (L2 rollup) raised $28M.

Blackrock launched “the BlackRock USD Institutional Digital Liquidity Fund (BUIDL)”, a tokenized money market fund that invests in cash, U.S. treasury bills, and repurchase agreements run on the public chain Ethereum. Wall Street Journal According to Bloomberg, by March 27, one week after its launch, BUIDL has attracted $240M.

SEC is investigating the Ethereum Foundation, according to some reports from media like Fortune. The question is what the SEC is investigating, whether the Foundation’s ICO was an unregistered securities activity, or whether ETH is a security. One thing is clear it has nothing to do with the ETH spot ETF review process.

Biden’s 2025 budget proposal includes a crypto mining tax and implements a wash-sale rule, in the hope of collecting a $10B tax if Congress passes it. CoinDesk

FalconX is expanding to Hong Kong, offering OTC digital asset trading, prime brokerage, and derivative services for institutional investors. Falconx LinkedIn

The void can never be filled, or not for quite some time in the future, after SVB’s fall. PitchBook

🎥BlockchainAsia Podcast

Since late February this year, I have done three Podcast interviews with:

HashKey Capital’s Jupital Zheng about their liquid funds

Canaan Inc.’s Leo Wang about Bitcoin mining, halving, and its impact on the market

Future3 Campus’ Du Yu about Web3 mass adoption, DePin and AI Web3

You can listen via Subtack Podcast, Apple Podcasts, Spotify Podcasts, Google Podcasts, YouTube

🌻Events in Asia

Hong Kong Web3 Festival, Hong Kong, April 6-9

Bitcoin Asia, Hong Kong, May 9-10

DEVCON Southeast Asia, Bangkok, Nov. 9-17

Sora Ordinal Summit, Taipei, December 13-14

I want to end this issue with the following quote. I forget who said this originally, but so true.

“If you're not willing to look like an idiot in the short term, you will never look like a genius in the long term."

Thank you for reading. Until next time, and enjoy the spring!

Coco

I am Coco Kee, author of BlockchainAsia, host of BlockchainAsia Podcast, and Co-founder of Kee Global Advisors.

Email me if you want me to include your company’s stories or interview you for the Podcast. Follow me on Linkedin and Twitter.

The content in BlockchainAsia newsletters and Blockchain Podcast is for informational and educational purposes only, represents personal views and opinions, and does not constitute investment advice or recommendations.